Location: Home >> Detail

TOTAL VIEWS

J Sustain Res. 2025;7(4):e250077. https://doi.org/10.20900/jsr20250077

1 Faculty of Business and Communication, INTI International University, Persiaran Perdana BBN Putra Nilai, Nilai 71800, Negeri Sembilan, Malaysia

2 School of Management, Jiujiang University, Jiujiang 332005, China

3 Gustavson School of Business, University of Victoria, Victoria, BC V8W 2Y2, Canada

4 Department of Management Studies, University of Barishal, Barishal 8254, Bangladesh

5 Department of Oral and Maxillofacial Surgery, Sher-E-Bangla Medical College, Barishal 8200, Bangladesh

6 Faculty of Management, Shinawatra University, Pathum Thani 12160, Thailand

7 Wekerle Business School, College in Budapest, Budapest 1083, Hungary

8 Doctoral School of Management and Business, Faculty of Economics and Business, University of Debrecen, Böszörményi út 138, Debrecen 4032, Hungary

9 Business Administration Program, Applied College at Sarat Obeida, King Khalid University, Abha 62529, Saudi Arabia

10 Department of Finance, College of Business Administration, Hotat Bani Tamim, Prince Sattam bin Abdulaziz University, Al-Kharj 16273, Saudi Arabia

11 Faculty of Economics and Business, University of Debrecen, Böszörményi út 138, Debrecen 4032, Hungary

* Correspondence: Md. Abu Issa Gazi, Mohammad Bin Amin

Purpose: This study aims to investigate the impact of Green CSR (GCSR) on bank employees and on the banks’ sustainable performance (BSP). The objective of this paper is to investigate the association of Green banking (GB) practices with Green brand image (GBI) and Green banks policy (GBP) by the State-owned commercial banks (SOCBs) and Islamic commercial banks (ICBs) in the context of Bangladesh, a developing economy in South Asia.

Methodology: The research was conducted on 420 employees who worked in SOCBs and Islamic banks in Bangladesh. Structural equation modeling (SEM) was used to analyze relationships among the variables.

Findings: Results show that GB practices significantly and positively influence banking sector GBI as well as GBP development. Furthermore, GBI and GBP of banks contribute to improving sustainable performance (SP). The findings indicate that GB’s operational, staff, and environmentally based CSR practices have a significant influence on BSP.

Originality/Value: This paper deserves attention because it is one of the first papers to address multiple GB practices and their impact on GBI and GBP. This paper is the first to examine the long-run sustainability of the Bangladeshi ICB and SOCB, the impact of GBI and GBP.

Implications: The study contributes significantly in understanding the factors that enhance the effects of GB practices on sustainable banks and the advocacy of sustainable banking and GB practices.

Green concept and corporate social responsibility among sustainable business (SB) practices significantly act as antidotes to global warming and climate change [1,2]. To reduce environmental damages and ensure sustainable economic stability it is necessary to practice responsible banking or so-called “green banking” [1,3]. International concerns about sustainability are growing, and initiatives like GB are meant to minimize environmental damage and to affect sustainability in an effort to save our world. GB has been reinforcing its in‐house environmental practices and sustainability impression internal and in‐between the clients in recent years [1]. Responsible business practices, such as GCSR activities, are a strategic tool to achieve sustainable development, which involves delivering economic, social and environmental benefits for all stakeholders. These are now being recognized as the most effective means to combat climate change and global warming [1,2,4–6]. Green banking (GB) to curb environmental degradation by ensuring sustainable economic growth is a need of the hour [7,8]. Because environmental degradation and eco-friendly businesses in the form of green finance are more prevalent in today’s world than past for the preservation of the world [9,10]. Green Banking (GB) has become popular in recent decades through promoting environmental sustainability in their operation internally as well as how they contribute for encouraging sustainability in their clients [2,9,10].

Edwards [11] claims that sustainability is a “mega-new trend” and a top business priority, which promotes the development of green business innovation. The banking sector is experiencing a big change towards sustainability due to ecological matters and long-term financial sustainability [5]. Those who practice activities that are harmful to the environment fish for money and economic development. Regardless of their level of development, both industrialized and developing countries are faced with the challenge of climate change. Because global warming is in full force, underdeveloped countries are increasingly vulnerable as they modernize their societies and economies. These countries rely significantly on international climate finance to further national actions to address global warming [12]. Bangladesh is one of the most vulnerable countries to climate change as rising sea levels threaten not only the ecosystems that support its population but also the economic viability of the nation. Consequently, a series of polices have been introduced to reduce risk and negative climatic impacts. This kind of GB taking includes (1) application GB; (2) the corresponding GBI, in accordance with international laws; and (3) sustainable development that would prevent ecological destruction [1,7,12]. GBI refers to the brand cognition in the customers’ mind related to environmental concerns and commitments. GB stands for Banking on ecological, social and economic criteria for the conservation of ecosystems and renewable resources. That’s investment in environmentally friendly goods and services that bring about climate change mitigation and protect valuable environmental assets. GB is considered essential to economic development and sustainability in Bangladesh [13]. The above discussion states that we can safely claim that GB has become very important for the whole world to combat climate change and the achievement of SDGs [5].

Bangladesh banking can contribute in the rising global necessity of clean garbage-less environment management in fighting against littering. Accordingly, GB is dominated in the current advanced banking industry rather than traditional banking [5,14]. In order to prevent further environmental degradation, a number of mechanisms have been set in place such as adopting GB or particularly, GBI benchmarking to the international standard to achieve sustainable economic development. These schemes to stimulate Green Banking (GB) in the financial sector by promoting sustainable development in the face of human-induced environmental destruction [15]. International agendas, like Paris Agreement, and the G20, have stressed on the role of banking in environment protection and sustaining the environment [16]. The aim is to make banks more efficient, incentivize businesses to think about the environment and reduce the use of IT and buildings. In 2011, Bangladesh became one of the frontier countries in adopting GB approaches to sustainable economic growth [2]. The role of Bangladesh Bank (BB), which is the central bank and the regulator of the banking industry in Bangladesh, played to GBI advancement through the wider diffusion of GB [7]. Green banking (GB) is an important development for the promotion of a sustainable green economy, as it assists developing countries to improve their economies in a sustainable way, reducing pollution and energy consumption [7,12].

A number of international studies have been conducted on GB over the past years [1,12]. This includes GB adoption and economic development in Bangladesh and GB adoption, performance, acceptability and environmental sustainability in [2]. Additionally, only limited studies examine how governance practices affect the environmental performance of banks in Pakistan [17], Nepal [18], India [19] and Sri Lanka [20]. Several studies are also performed on GB of Bangladesh banking sector from the perspective of the relationship of governance infrastructure, governance performance, and environmental performance of banks [2,7,13].

Many studies have been conducted on the issue of Green Banking (GB) and sustainability, but the studies on the joint effect of GB, GBI, and GBP on the SP of banks in Bangladesh are scarce. New studies only cover commercial and private banks and ignore Islamic banks and SOCBs. But the moderating effect of GCSR was less focused in this sector. There is limited empirical evidence on the effect of GCSR on the relationship between greens and sustainability. As a result, there is very limited knowledge about sustainable financing in the case of poor countries like Bangladesh. The gap is evidence of a segmentation between Islamic and state banks that the present paper wishes to bring back together.

But evidence on the effects of GB practices on SP is limited. It evaluates their effects on GBI, GBP and sustainability, with a focus on the relationship between GBI and GBP. Research is available on GB practices; however, the implications of GB on GBI, GBP, and sustainability on Bangladesh’s ICBs and SOCBs is not well explored. Key research questions include:

RQ1: What are the effects of GB on GBI, GBP, and BSP?

RQ2: What are the roles of GBI and GBP in such outcomes, particularly in Bangladesh?

Our aim is to contribute significantly to this new field of GB investigation. The research has a number of significant implications to the current body of literature. To begin with, although previous studies examined the significance of GB in overall sustainability results, few studies have combined GBI and GBP as the two mediating variables between GB practices and SP in Bangladesh. Second, this study adds a moderating variable, which is GCSR, providing a more subtle view of how environmental responsibility initiatives enhance the level of association between GB and sustainability. Third, unlike previous research which mainly involved private or commercial banks, the current research incorporates Islamic and state-owned banks hence offers a more detailed background of the Bangladeshi banking industry. Fourth, the study can also offer important information on how developing countries can bring financial activities in line with sustainable development objectives (SDGs) by concentrating on an emerging economy that is particularly susceptible to climate change. Lastly, the research brings some contributions to the literature of GB by creating a conceptual framework that relates GBI, GBP, and GCSR to SP that has its value in both theoretical and managerial development. Combinations of these contributions make it clearer how the implementation of green financial practices might be thoughtfully planned to make organizations and the environment more sustainable in developing countries. It attempts to address limitations of extant research on green behavior and sustainability. Although this study focuses on Bangladesh, the findings offer insights applicable to other developing economies with similar GB initiatives. The primary aim is to help public authorities and practitioners to support sustainable banking by focusing on bases such as staff behavior and customer relations but also the environmental and social responsibility of banking operations. This will help to achieve its common sustainability goals.

Legitimacy of the organization-environment relationship is “a judgment about action in its shared or common, as well as contested, nature upon action engagement” of the social system [7]. The legitimacy of an organization is a core concept of legitimacy theory and it is characterized as a constructed state or condition that an entity creates that is based on the compatibility of the value system of the entity with the value system of the society with which the entity interacts. The value of. Moving along the path toward more preferred sets of values. We look at the shortcomings of the power-peripheral to the interdependent power at the other part of tolerated through the fact merely value systems. According to [21], “legitimacy is the degree of interdependence between the organization and the external environment, and legitimization is what organizations do to show the fit and to alter the values”. Authenticity is achieved by showing that a company’s behavior is consistent with its society’s beliefs and values. Secondly, this paper uses environmental legitimation to profile the environmental legitimation process which consists of conforming to legislation, formation of an environment committee or appointment of an environment manager to focus on ecological impacts, formation of networks and committees with local representation, making the site undergo an environmental audit, emergency response plan, and highlighting cooperation with environmental group. According to legitimacy theory, organizations with a poor environmental record may choose to report biodiversity information [7,22]. Therefore, the environmental justice organizations could compel polluting companies to increase their spending for the environment, and environmentally oriented licenses to be controlled by new eco-friendly technologies [7,12]. This is important because organizational social value additionally drives organizations to behave in certain ways to secure their legitimacy in their environment [7,18,23] template is ubiquitous in this respect: “organizations… establish formal structures that reflect the characteristics of isomorphic structures without concern for isomorphic efficiency”—so as to capture legitimacy, resources, stability, and (increased) opportunities for survival [24]. Brown & Deegan [25] however postulate that the legitimacy theory is based on the idea that there is a social contract which is an assumption that a business organization exists because it has observed the norms and values of the community. To Hu and Bentler [26] the legitimacy theory is predominant in explanation of what motivates organizations to voluntarily publish social and environmental accounting reports. Organizations pattern and reclaim the image to the approach of legitimacy theory practitioners out of the mirror of the social and environmental reporting activity [7,27,28] to collaborate and benefit from various programs such CSR, GB, GBI, they must come together as they all have a mutual identification in common that is beneficial of its interests as a country for the prospect of developing such country in long term basis. Legitimacy considering as prevailing belief that banks of Bangladesh are operating as per the legitimacy of BB [7,29]. Thus, firms must choose between what is in agreement with socially-held notions, norms and customs.

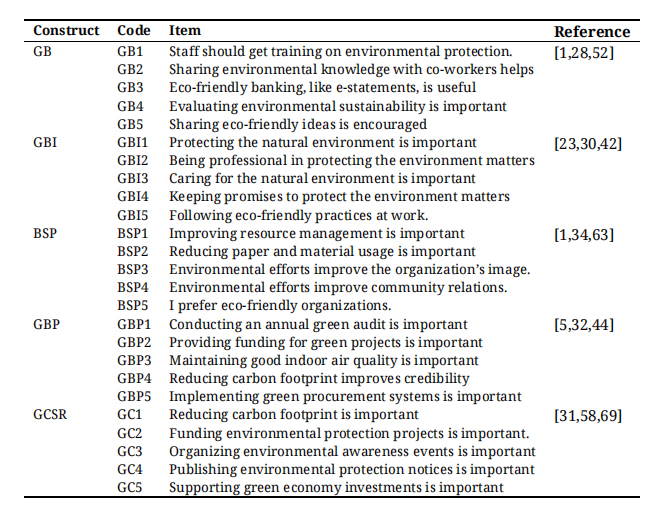

Green Banking (GB)Green Banking (GB) is becoming popular in Bangladesh amidst distinctive threats to the environment, in the form of air and water pollution, deforestation, and climate change. A few banks in Bangladesh have adopted GB in recent years, recognizing the urgency to address these issues. The Bangladesh central bank is at the forefront in promoting GB in the country. The Green Banking policy (GBP) was introduced in 2011, including a number of financial constraints. Financial institutions are in legally required to practice environmental sustainability in their operations and to integrate ESG criteria into their lending and investment decisions [30]. The various opinions in the GBP are influenced by financing environmentally friendly measures including renewable energy, energy efficiency and sustainable infrastructure. Banks are motivated to adopt green measures such as saving energy and paper [7]. The Bangladesh Bank (BB), to enhance GB, has implemented some initiatives such as BSFI and Sustainable Finance Refinancing Scheme (SFRS). The BSFI seeks to establish a platform for banks, regulators and other relevant stakeholders to share their views on ESG (environmental, social, governance), while the SFRS offers low-cost finance to help companies invest in environmentally sustainable assets and equipment, among other schemes. Financial intermediaries need to devise individual investment strategies that agree with their clients’ environmental preferences. Recommendations suggested include developing environmentally sustainable branches and GBI, include environmental issues in credit risk assessment criteria format, idea of a training or guidebook for project evaluation related to environment risk and to disclose GBI publicly [7,13] (see Table 1).

Hypothesis FormationTo empirically test the proposed relationships, all constructs were measured using multi-item Likert-type scales (1 = strongly disagree, 5 = strongly agree) adapted from prior validated studies (see Appendix A for complete questionnaire). The following sections discuss the conceptual relationships among the constructs and develop hypotheses consistent with the proposed model.

GB and BSPSustainable banking, also known as ethical banking, is a form of banking that takes into account not only its purposes in and of the movement of money, but also the social and environmental impacts that it has in the market. The GB is an approach that focuses on environmental conservation, the fostering social and economic development and that is committed to sustainable development. The idea of GB starts with Triodos Bank, a bank which was launched in 1980 and was first of its kind to obligate the banking sector for environment safety [7]. These risks can be addressed through investments and financial decisions and institutions may use GB as a tool to address climate risks and move capital away from high carbon investments. Additionally, GB has the potential to attract investors and consumers with ethical motivations who want the companies they invest in or purchase from to be socially and environmentally responsible [40].

“Our bank promotes environment-friendly banking operations,” “Our bank encourages clients to use digital or paperless banking services,” and “Our bank invests in eco-friendly projects” are some of the statements that are used in this study to measure GB. These statements are taken from [2,10]. These products show how banks are attempting to incorporate sustainability into their financial and operational processes. GB policies seek to improve the financial system in line with sustainable development goals and make the move toward a low-carbon economy easier. By following these regulations, banks can improve their sustainability performance, help transition to a low-carbon economy, and can foster sustainable economic growth [41].

It is the ability to remain in good health for a long period of time, perhaps indefinitely. This also includes the environmental side. People might mistake the word “environment” with “sustainability,” though they are separate definitions [42]. Sustainability performance management is a contemporary concept used in handling the relationships among environmental, social, and economic features in corporate governance and in corporate sustainability management, in specific. It has been established in the past that long-term SP comes at the expense of paying attention to the future—looking after future generations. The context of sustainability. Sustainability is an enduring system based on the trail in economics, society and environment. These three realms are known as the Triple Bottom Line. Many researchers concentrate on these isolated factors, a few investigate the linkages of economic, environment, and social sustainability [40,43]. Studies carried out in Coimbatore, India reveal that these governance initiatives have led to a significant improvement in the environmental performance of banks. Risal et al. [44] examined the influence of governance mechanisms on the environmental performance of the banks in Nepal.

According to Khairunnessa et al. [40], this connection suggests that banks that use GB practices are more likely to attain greater levels of SP, which is measured in terms of environmental, social, and economic results. Items like “Our bank’s activities contribute to reducing carbon emissions” and “Our bank enhances community welfare through green initiatives” were used to evaluate SP. The long-term SP of banks is therefore anticipated to be strengthened by the integration of GB into basic banking activities.

Previous studies, such as [4,5,7] demonstrate that GB practices significantly influence BSP through stakeholder-focused strategies. Similarly, refs. [37,41] provide empirical evidence that green initiatives and sustainable management practices directly contribute to long-term environmental, social, and economic outcomes. These studies support the theoretical expectation that GB positively affects BSP.

Hypothesis (H1). GB is positively related to BSP.

GB, GBI and the BSPA GBI is an alternative measure of people’s opinions of a company’s commitment to being environmentally sustainable and eco-behavior. GBI has strong association with GB practices [45]. Its GB performance is likely to affect the GBI for the bank. For instance, if a bank applies environmental-friendly approaches in its green corporate social responsibility, employee participation, operational performance, customer satisfaction (CS), and policy development practices, it will be viewed as a socially responsible organization with an efficient sustainability program [4]. Items such as “Customers perceive our bank as environmentally friendly,” “Our bank’s image is associated with sustainability,” and “Our bank communicates its environmental commitments effectively” were modified from [46,47] to measure GBI in this study. Stakeholders’ opinions of a bank’s green reputation are captured by these metrics. It can also draw customers, investors and partners who value sustainability and want to do business with a company that thinks ecologically and socially. GBI refers to “perceptions formed as a result of communications between the institution, staff, clients and the community relating to environmental commitments and issues” [38]. By adopting sustainable and reliable GB practices, an FI can improve both its environmental performance and reputation [4]. That will appeal to clients who are environmentally aware. People assume if a bank has GBI it is also caring about the environment, society and also thinking on their own carbon foot prints and negative impacts. A bank’s capacity to outperform competitors, grow, innovate and find new markets largely depends on the governance of the bank and the managerial practices that are possessed within the balance sheet and income statement. A successful GBI implementation can help banks to practice GB and facilitate the integration of environmental factors in practice [1]. This may set in motion a virtuous circle when the bank, committed to sustainability and environmental issues, improves its image and attracts environmentally aware customers, who, in turn push the bank to develop wider GB [27].

Empirical evidence indicates that GBI acts as a mediator between GB and SP. For example, Ref. [7] shows that stakeholders’ perception of a bank’s environmental responsibility strengthens when GB practices are implemented effectively. In addition, Bhatti et al. [29] and Gerged et al. [34] found that CSR communication and governance practices enhance customer and stakeholder perceptions, which further reinforces SP outcomes. These findings align with the proposed mediating role of GBI. Therefore, GB practices serve as precursors to GBI, and greater SP follows from improved GBI.

Hypothesis (H2). GBI mediates the relationship between GB and BSP

Hypothesis (H2a). GB is positively related to GBI

Hypothesis (H2b). GBI has a positive relationship with BSP

GB, GBP, BSPThe comprehensive framework that governs the bank’s vow to incorporate environmentally sustainable and responsible parameters into their day-to-day operations is termed as the ‘green banking policy’ [48]. This policy is an overarching policy that integrates green and environmentally friendly decisions and green finance in the product portfolio of the bank [46].

Items from Bose et al. [2] and Laskowska [48], such as “Our bank has formal policies promoting green investments,” “Environmental risk assessment is part of our credit approval process,” and “Our bank monitors compliance with green policy guidelines,” were used to measure GBP in this study. These items show how environmental principles are institutionalized within banking operations. By maintaining the norm or adopting it, the bank allocates attention towards the survival of ecology-friendly projects, for sustainable or ecology-sensitive lending and investment, and for sustainability awareness [38]. The policy is a catalyst for these efforts, guaranteeing that they are undertaken in accordance with the bank’s broader strategy of high environmental performance [48]. There is a positive association too of applying GB strategies, which is composed of organizational and policy-level actions [49]. Mehta et al. [50] in another study argue that major green business strategies are useful in facilitating a nation to sustainable economic development these includes going from paper to electronic communication, by use of green checking account, green loan for home improvement or other purposes, adopting a green policy, use of green credit card, use of Solar energy, and purchase of eco-friendly products or services. So we can assume that GB is a proportion for (bank) in order to control the spread of carbon emission and the habitats in order to improve their CREE and finally LCCW of economic of SD activities in the bank [51].

Recent studies support the mediating role of GBP. Ref. [7] highlight that formal policies promote sustainable financing and ensure consistent implementation of green initiatives, leading to higher SP. Yahya & Zargar [36] and Malik et al. [27] further emphasize that institutionalized green policies facilitate accountability and operational alignment, strengthening the effect of GB on BSP.

Since policy enforcement guarantees consistent and quantifiable environmental impact, it is reasonable to assume that the existence of a strong GBP mediates the relationship between GB and BSP.

Hypothesis (H3). The relationship between GB and BSP is mediated by GBP

Hypothesis (H3a). GB is positively related to GBP

Hypothesis (H3b). GBP is positively associated with BSP

The Moderating Role of GCSRGCSR represents the corporate expression suggested by the insertion of the sustainability and environmental care throughout all of the strategies that the organization executes. These include moderating carbon emission, delivering sustainability, and creating social good that occurs for both communities and industries [52].

Items such as “Our bank implements CSR programs focusing on environmental sustainability,” “Our CSR initiatives aim to minimize environmental footprints,” and “Our CSR policies encourage employee participation in green activities” were modified from Zhang et al. [53] and Gazi et al. [1] to measure GCSR in this study. These products show how socially and environmentally conscious banks are.

Staff involved in GB may impact the bank’s interactions with stakeholders with regards to CSR issues, and so increase transparency and responsibility in the reporting and formulation of CSR measures. These will expose a culture of sustainability in the bank, which in the long run will translate into value to the bank in form of its name and commitment as far as CSR goes for it to initiate more and bigger CSR projects. GCSR is defined as banks’ pledge to responsible activities with positive environmental and social effects [1,12] include programs on minimizing environmental footprints and the way in which green can be attained [1,37]. Employee participation in GB may enhance the bank’s GCSR activities, sustainable banking and environmentally friendly activities. Moreover, the Theory also states employees as significant internal stakeholders involving key players contributing to or hindering firms’ fulfillment of CSR duties, especially with regard to the environment. The activities in which they are involved have a strong relationship with the influence they exert on a bank’s ability to meet external stakeholder expectations, including that of customers, the media, regulators, and society as a whole [47,31].

The moderating role of GCSR is supported by prior research. Gazi et al. [1] Bhatti et al. [29], and Yahya & Zargar [36] demonstrate that CSR initiatives focused on environmental and social sustainability enhance stakeholder trust and engagement. Luu et al. [39] further shows that CSR programs strengthen internal alignment and amplify the benefits of GB on SP. These studies support our proposition that GCSR moderates the relationship between GB and BSP.

Also, a bank’s reputation, resource allocation, and stakeholder support for sustainability are all strengthened by a strong commitment to CSR, which may increase the beneficial effects of GB on BSP (Figure 1).

Hypothesis (H4). GCSR moderates the link between GB and BSP.

We constructed and conducted a written, structured, interviewer-administered questionnaire, which was based upon a literature review. Survey items were based on a review of the literature. Pilot testing and formal survey. Prior to the formal survey, a professor who is an expert in quantitative analysis verified the questionnaire to confirm its validity. This quantization procedure enables the application of statistical methods to a statistical interpretation of data. The measurement items were pre-tested in a pilot with 20 respondents. Pilot study enabled the researcher to detect, eliminate deficiencies, and increase validity and reliability of the research instrument. The Composite Reliability showed for all variables of Cronbach Alpha good reliability items, from 0.700 or higher, and confirmatory factor analysis (CFA) good construct validity. No substantial common method bias was identified in Harman’s test. These established the criterion validity and reliability of the questionnaire with respect to data collection and analysis. The respondents are the employees of some State-Owned Banks and International Commercial Banks (ICBs) in the Barishal region. Once we analyze the multi-collinearity the rest analysis can be done with our data. The final survey questionnaire had two parts. Part A focused on the racial/ethnic profile of the sample. For Part B, the 25 questionnaires (5 for each complexity or size) were employed to gather the participant perceptions and to determine what helped and/or got in the way.

Survey Administration and SamplingWe contacted 6 SOCBs and 6 ICBs seasoned staff members in the bank to collect data from these important stakeholders through a convenience sampling to enrich the essential viewpoints. The principal financing providers of the GB initiative, the ICBs and the SOCBs have been promoting the introduction of GB in Bangladesh. But independent brokers are assuming that responsibility. Hence, the present study purposely involved both ICBs and SOCBs in its sample selection. The original data were used in the current study in order to achieve the aims. The majority of the primary data was collected from employees of targeted ICBs and SOCBs via a non-haphazard sampling. The convenience sampling was used in the institutions as it was not possible to obtain a fully list of banking personnel from the institution. A total of 420 questionnaires were distributed and collected through an online Google Form. All items were set as mandatory, ensuring that every question was answered before submission. Consequently, all 420 responses were valid and included in the final analysis. Demography of the sample will make the findings more generalizable. Google form feedback was applied from 12 June 2025 to 15 July 2025 by a five-point Likert scale to analyze minor differences between GBI and GBP and how the two affected other variables, making the collected data more accurate and comprehensive.

Tools and AnalysisThe established analysis technique was SEM, as it adeptly tests the construct validity and reliability of the theorized interrelationships among the model constructs. This was an important decision, and it made our analysis more precise. Software tools Amos-24 and SPSS were applied to obtain simultaneous and rapid measurement and structural models. The software tools do apply pretty stringent statistical techniques. First, we tested the measurement model by following the guidelines provided by Anderson and Gerbing [16] regarding how variables and items should relate to each other. And we use a structural model approach to analyze the variables and their relationships. Convergent and discriminant validity of the measurement model were tested for research constructs.

Items ReliabilityThe sample size (n = 420) is appropriate for statistical analysis. The survey’s current driving to categories of GB, GBI, GBP and BSP were examined by Cronbach’s alpha coefficient. the total Cronbach’s alpha of 0.961 obtained by the analysis is very good. Similarly, the internal consistency for all the scales, which was measured by the Cronbach’s alpha coefficient, also indicated that the items were highly consistent and more appropriate for subsequent analyses (Table 2).

MeasuresAll measurement items for each construct were adapted from previously validated scales in the literature. The study examines employees’ perceptions of the relationships among GB, GBI, GBP, BSP, and GCSR. Each item was measured using a seven-point Likert scale ranging from 1 (“strongly disagree”) to 7 (“strongly agree”).

GBGB refers to environmentally responsible banking practices that integrate sustainability into financial operations and services [1]. This construct was measured using five items adapted from [32,54]. Sample items include statements such as “E-bills represent a positive advancement; sustainable banking practices signify a beneficial approach.” The scale demonstrated a Cronbach’s alpha reliability of 0.948 in this study.

GBIGBI reflects employees’ and customers’ perceptions of a bank’s commitment to environmental responsibility and sustainability [5]. It was assessed using five items adapted from Gazi et al. [5] and Sharma and Choubey [54]. A sample item includes “The advancement of expertise in conservation is crucial.” The Cronbach’s alpha for this construct was 0.971, indicating high internal consistency.

GBPGBP represents the operational efforts of banks to implement environmentally sustainable procedures, such as green financing and paperless transactions [1,32,41]. It was measured using a five-item scale adapted from prior studies. A sample item includes “Allocating financial resources for environmentally sustainable initiatives is essential.” The reliability coefficient (Cronbach’s α) was 0.964.

BSPBSP refers to the bank’s ability to achieve long-term growth while balancing environmental, social, and economic objectives [4]. It was measured using five items adapted from Gazi et al. [5] and Malsha et al. [41]. A sample item includes “Sustainability initiatives improve the company’s image.” Responses were recorded on a seven-point Likert scale. The Cronbach’s alpha for this construct was 0.965, demonstrating strong reliability.

GCSRGCSR captures the bank’s commitment to environmentally responsible policies and practices as part of its CSR strategy [1,41]. It was measured using five items adapted from previous studies. A sample item is “It is essential to provide financial backing for initiatives aimed at environmental protection.” The Cronbach’s alpha for this construct was 0.962.

Common Method Variance (CMV)Verification of the CMV in the current study is conducted through Harman’s single-factor test. Podsakoff et al. [55] note that over-general CMV problems may arise when a single construct accounts for more than 50% of the variance, or when items load into a single category. Results of the tests indicate no existence of CMV in the data. The first component explains 22.22% of the cumulative variance, and only a small number of components have eigenvalues that exceed unity, as Sun et al. [55].

The demographic information of the 420 banking employees in the sample is presented in Table 3. The survey illustrated that SOCBS accounted for 53.6% and ICBs 46.4%. Men accounted for 53.6% and women 43.6%. 13.3% were ≤25 years, 28.1% were 26–30, 16.4% were 31–35, 20.5% were 36–40 years old. At an educational level, 13.1% had postgraduate studies, 32.4% had graduate studies and 8.3% held a PhD. And so, many respondents were assumed to be highly educated. Of the respondents 27.6% were managers, 28.8% assistant managers, 15.2% officers, 19.0% banking trainees and 9.3% others. 25.5% of the researchers worked for less than 5 years, 25.2% for five to 10, 30.2% for 11 to 15 and 19.0% for over 16 years.

Inter-Item Correlation MatrixCorrelation Matrix in Table 4, the matrix of correlation can be found between the variables. GCSR has the strongest positive relationship with GB (r = 0.256), followed by GBI (r = 0.191) and BSP (r = 0.165). The correlation coefficients are all well below the critical levels, indicating no multicollinearity.

Inter-item correlation matrix Positive inter correlation exists between all 5 factors that damage GB practices. The strongest association is observed between GB and GBI (r = 0.270), followed by GB and GBP (r = 0.251), suggesting a uniform convergence in basic GB activities. BSO shows somewhat lower relationships with other dimensions (GCSR: r = 0.165; GBP: r = 0.203) suggesting improved discriminant validity. There is a moderate positive relationship between GCSR and GB (r = 0.256), that indicates its position in a cluster of GB. The gaps in value are not only conceptual but are also consistent among the components. Though the correlation values among the constructs are relatively low (ranging from 0.12 to 0.27), this does not necessarily indicate a problem with the measurement model. As noted by Hair et al. [56] low to moderate correlations may occur when constructs are conceptually distinct yet theoretically related. Furthermore, the internal consistency and convergent validity of all constructs were verified through acceptable Cronbach’s alpha (≥0.70), Composite Reliability (CR > 0.70), and Average Variance Extracted (AVE ≥ 0.50) values, as presented in Table 4. These results collectively support the reliability and validity of the constructs despite the relatively weak inter-construct correlations. Therefore, the low correlation coefficients are interpreted as evidence of construct distinctiveness rather than measurement deficiency.

Descriptive Statistics (EFA)Results from EFA the main results of the EFA are presented in Table 5. High correlation to analyze pattern was proved by the correlation matrix analysis. The sample adequacy measure, Kaiser-Meyer-Olkin, was within the acceptable limits at 0.916.

Descriptive StatisticsAfter removing duplications and incomplete questionnaires, we analyzed 420 responses. The mean values of the elements for the six used structures are presented in Table 6. The table shows the respective standard deviation of each construct with the range of their mean values. The following are found: 5.61 to 5.74, 5.76 to 5.71, 5.73 to 5.63, 5.56 to 5.53, 5.65 to 5.63. The computed means suggest that the mean opinions of the respondents were in line with the voice in questions of the survey. This shows that the great majority of participants have a positive attitude towards the tested factors. The evenness of the data was examined using skewness and kurtosis. Accuracy of data collection was reliable as demonstrated by values of skewness and kurtosis in the table, which were found within normal values. The data indicate the minimum and maximum response rates for each question asked. The Cronbach’s alpha levels of all items were higher than cut-off value for good internal consistency (0.7). Further, Table 6 shows that all item factor 104 loadings surpass the pre-determined value, and hence, a high internal consistency of the constructs is indicated.

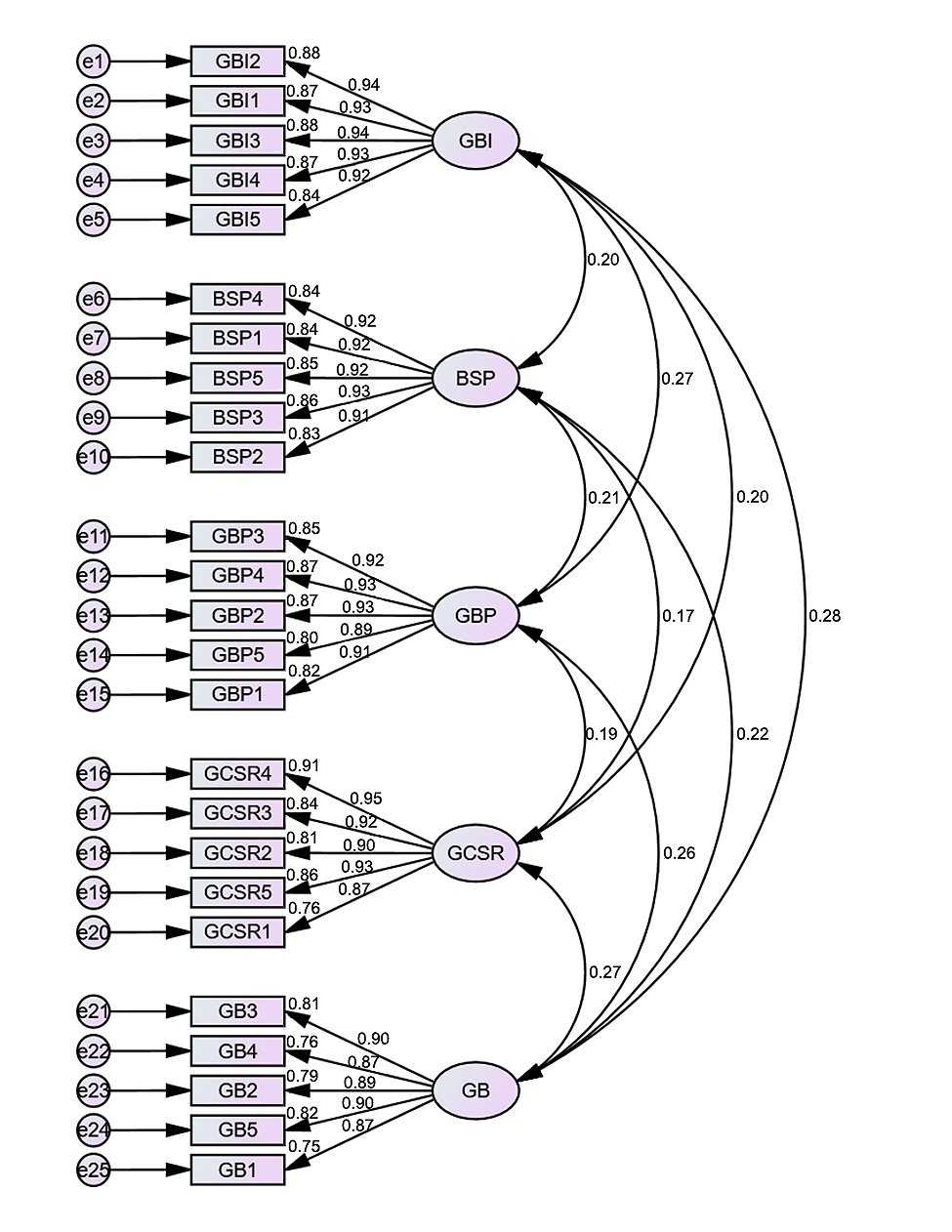

Measurement Model EvaluationAs shown in Figure 2, all latent constructs are correlated, which is expected in the CFA stage to assess discriminant validity and construct interrelationships. However, in the structural model tested later, only the hypothesized directional paths were specified according to the theoretical framework. Figure 2 depicts the CFA measurement model, where all latent constructs (GB, GBI, GBP, GCSR, and BSP) are intercorrelated to assess construct validity. The double-headed arrows represent correlations rather than causal paths. In the subsequent structural model, only the hypothesized directional relationships are specified according to the theoretical framework (see Figure 3). Two internal consistency measurements (reliabilities) are also used to test the scale constructions and, therefore, the reliability of the measurement model. The results of the study by Hair et al. [56] reveal that the CR of composite (CR > 0.70) and Chronicle (α > 0.70) meet the criteria of satisfactory performance. Criterion validities have two preconditions: a loading of factors (AVE) and the agreement value (AVE > 0.70) [57]. In order to warrant discriminant validity, the highest of the bivariate variable correlations must be lower than the square root of the AVE [56]. Multicollinearity is considered high when VIF exceeds 10. We apply several fit statistics to assess the quality of the model. To measure the model’s goodness of fit, we use the chi-square test (chi-square = X2/d > 3), the RMSEA (0.90), the AGFI (0.85) and the GFI (0.85) [56,58].

Figure 2. CFA measurement model. (Note: The figure presents the measurement model used to confirm the validity and reliability of the constructs (GB, GBI, GBP, GCSR, and BSP). The double-headed arrows represent correlations among latent variables. The structural (hypothesis) relationships are tested separately in the subsequent model.)

Figure 2. CFA measurement model. (Note: The figure presents the measurement model used to confirm the validity and reliability of the constructs (GB, GBI, GBP, GCSR, and BSP). The double-headed arrows represent correlations among latent variables. The structural (hypothesis) relationships are tested separately in the subsequent model.)

In Table 7, precision and the reliability of the proposed measurement model are shown in step 1 End of Table 7. These results are good evidence for both discriminant and divergent validity, as they indicate that the AVE (greater than 0.50), factor loadings/pattern matrix (above 0.70), Cronbach’s alpha, CR (greater than 0.70) but not the square root of the AVE, should be higher than the inter-construct correlations. The calculated regression coefficients and values of VIF vary between 1.748 and 1.946, indicating once again the absence of multicollinearity in the model. Fit indices are given in Table 7 (CMIN/DF = 1.748, IFI = 0.984, RMSEA = 0.042, TLI = 0.982, CFI = 0.984).

Table 8 presents the standardized regression weights and related statistics for various constructs involved in the study, such as GB, GBI, GCSR, GBP, and BSP. Each construct is measured through multiple items or indicators, with details provided on their factor loadings, standard errors, t-values, means, standard deviations, and internal consistency (Cronbach’s alpha). High factor loadings and t-values (generally above 1.96) indicate that the items reliably and significantly represent their respective constructs. For instance, the items related to GB show very high loadings and t-values, demonstrating they are strong indicators of that construct. The Cronbach’s alpha values are mostly above 0.9, reflecting excellent internal consistency and reliability of the measures. Overall, the table indicates that the measurement model is robust, with well-fitting items that reliably capture the underlying variables, ensuring confidence in the subsequent analysis of relationships among these constructs.

Table 9 presents a validity analysis that examines the relationships between various constructs in the study. The diagonal values, such as 0.971 for GBI and 0.847 for BSP, likely represent the square roots of the AVE, indicating the internal consistency of each construct. The off-diagonal values show the correlation coefficients between different constructs, with significance levels marked by asterisks: *** for p < 0.001, ** for p < 0.01, and * for p < 0.05. These correlations help assess discriminant validity, ensuring that each construct is distinct from the others. Generally, for good discriminant validity, the square root of the AVE (diagonal elements) should be higher than the correlations with other constructs, which appears to be the case here. Overall, the table confirms that the measures used are reliable and valid for further analysis in the study.

Structural Model Analysis and DiscussionThe study employed SEM to test the hypothesized relationships among the constructs. The measurement model demonstrated satisfactory fit, indicating that the data adequately represented the proposed theoretical structure. The model fit indices (CMIN/DF = 1.899, CFI = 0.985, TLI = 0.983, IFI = 0.985, GFI = 0.928, AGFI = 0.909, NFI = 0.969, RMSEA = 0.046) are all within acceptable thresholds [56], confirming strong model adequacy (Table 10).

Table 11 presents the structural path estimates for the hypothesized relationships. All hypothesized paths were found to be statistically significant at p < 0.01, supporting the conceptual framework of the study.

Hypothesis (H1). GB → GBI

The path between GB and GBI (β = 0.286, p < 0.001) was positive and significant, confirming H1. This implies that adoption of GB practices—such as energy-efficient operations, green financing products, and digital transaction systems—promotes innovation within banks. The finding is consistent with Rehman et al. [59], who emphasized that green business practices encourage innovative technological and managerial solutions. It also aligns with the Resource-Based View (RBV), suggesting that internal green capabilities can stimulate innovation and long-term competitiveness.

Hypothesis (H2). GB → GBP

The relationship between GB and GBP (β = 0.266, p < 0.001) was significant, supporting H2. This result indicates that banks engaging in green practices tend to develop formalized green policies that institutionalize sustainability within their operations. The finding supports [10,28], who argue that policy frameworks serve as strategic tools that structure and evaluate green initiatives. In the context of Bangladesh, formal GB policies ensure that sustainability initiatives are implemented methodically and aligned with the bank’s environmental objectives.

Hypothesis (H3). GBI → BSP

A significant relationship was found between GBI and BSP (β = 0.127, p = 0.013), confirming H3. This indicates that innovative GB initiatives—such as environmentally friendly products, digital solutions, and sustainable financing models—directly enhance banks’ sustainability performance. This supports Malsha et al. [41] and Gazi et al. [5], who found that innovation in green products and processes leads to superior environmental and social outcomes. Hence, banks that emphasize innovation in their green practices gain both reputational and performance advantages.

Hypothesis (H4). GBP → BSP

The path between GBP and BSP (β = 0.138, p = 0.007) was also significant, supporting H4. This demonstrates that structured green policies improve the overall sustainability performance of banks. The result aligns with Khairunnessa et al. [40], who emphasized that regulatory and strategic frameworks strengthen banks’ environmental governance and long-term sustainability. Therefore, GBP serves as a key institutional mechanism linking GB strategies with measurable business outcomes.

Hypothesis (H5). GB → BSP

The direct effect of GB on BSP was significant (β = 0.146, p = 0.006), supporting H5. This indicates that the implementation of GB practices—such as eco-friendly resource management, waste reduction, and responsible lending—directly enhances business sustainability. The result supports Malsha et al. [41] and Gaziet al. [31], who reported that green operational strategies foster sustainability through resource efficiency and stakeholder satisfaction. This finding underscores the RBV argument that firms leveraging internal green resources achieve superior performance.

Mediation AnalysisThe mediation analysis, following Baron and Kenny’s [19] approach and bootstrapping (95% CI), revealed that both GBI and GBP significantly mediate the relationship between GB and BSP (Table 12). The indirect effects (GB → GBI → BSP = 0.034, p = 0.004; GB → GBP → BSP = 0.034, p = 0.003) confirm the presence of meaningful mediation. These findings suggest that GB influences sustainability performance both directly and indirectly through innovation and policy development. Thus, internal innovation and structured policy mechanisms act as vital channels through which GB practices enhance SP outcomes.

Moderation AnalysisTo examine the moderating role of GCSR, AMOS interaction terms were employed [60]. The interaction between GB and GCSR on BSP was found to be significant (β = 0.312, t = 7.553, p < 0.001), indicating that GCSR strengthens the relationship between GB and BSP (Table 13). This implies that when banks demonstrate a strong commitment to GCSR, the positive impact of GB on sustainability performance becomes more pronounced. The finding is consistent with Chandran [51], who argued that GCSR enhances stakeholder trust and reinforces green commitments, thereby amplifying the effectiveness of green initiatives (Figure 4).

Overall, the structural model confirms that GB positively and significantly influences business sustainability performance directly and indirectly through innovation and policy mediation, with GCSR further strengthening this effect (Figure 4). These findings have important implications for Bangladeshi banking institutions—particularly Islamic and SOCBs—emphasizing the need for integrated green strategies combining governance, innovation, and CSR to achieve long-term sustainability.

Human resource management has neglected GB, but this study has major ramifications. Governance behavior in Islamic and SOCBs, notably in Bangladesh, is little understood. The study found a strong correlation between GB (β = 0.15), GBI (β = 0.13), GBP (β = 0.14), and BSP. The research supports H1, showing a strong link between GB and BSP. This supports previous research [4,44,51] that found a positive correlation between employee-focused green business practices like environmental education and training, SP measurement tools, and green incentive systems and BSP. The research supports H2, showing a positive and significant link between GB and BSP through GBI. This finding supports previous research [32] that green business practices like environmental education and training, SP measurement technology, and government incentives for green initiatives improve business sustainability performance through green business innovation.

The study supports H2a, which links the GB to GBIs. Rehman et al. [59] found a favorable correlation between GBI and GB adoption. H2b is supported by the study’s findings that GBI specification increases BSP degree. This finding supports Tandoh et al. [61] and Gazi et al. [31,32] findings that GBI improves BSP. Government regulations can help the GB Initiative grow. To protect the environment for GB performance and reduce social consequences, this is essential. This study supports H3. GBP sits between GB and BSP. GB reflects the bank’s environmental policy. GBP ensures these initiatives are methodical and meet bank goals. The mediating role supports Bukhari et al. [62] by emphasizing regulatory and strategic areas’ significance in long-term environmental performance. The analysis found a substantial and positive relationship between GB and GBP, supporting theoretical and empirical statements in the literature. Policy frameworks organize, direct, and evaluate GB activities, explaining the positive link [34,63,64]. The results refute H3b and show a strong positive correlation between GBI and BSP. This supports previous research [65,66] that green business practices, such as adding green branches, enforcing green policies, and building sustainable supplier and shareholder relationships, improve environmental performance. These findings support H3b. GCSR improves GB and BSP. Effective bank GCSR boosts GB’s sustainability. According to Chandran [67]. GCSR boosts stakeholder confidence and green promises.

To summarize, bank’s GBI, GBP and BSP are influenced directly and indirectly by the banks’ GB operations that incorporate customer, employee and GCSR activities. This is the justification for the nation’s long-term growth. Preserving the earth for future generations is something that is being accepted by all these communities. The research aim was to understand how GB practices influenced BSP and GBI and GBP were formed in Bangladesh through ICBs and SOCBs.

Theoretical ImplicationsThis study makes a theoretical contribution by using Legitimacy Theory to sustainable banking. Based on Legitimacy Theory, organizations conform to the concerns, values, and expectations from society, seeking to gain legitimacy, keeping their activity and surviving in the long term. The findings of this study suggest that GB programs inducing a GBI and the creation of GBP do not act exclusively in the strategic or even regulation logic, but in the legitimacy one, the one in which banks are able to signal their alignment with the social and environmental values [68].

Banks, by providing finance to green projects, may play the role described in the “social contract” of banks in environmental protection and communicate itself to the stakeholders as a socially responsible institution operating within the regulatory context and society’s expectation tripods. This behavior is consistent with the view that firms are pressured into voluntary environmental disclosure and activities to preserve or regain legitimacy. The study shows the importance of GBI as a solid resolve legitimacy [69–71] that sends signals to multiple stakeholders about a banks’ commitment to eco-sustainability, raising its reputation and stakeholders’ confidence. The inclusion of GBP also structurally bridges the issue of environment within the organization. Organizations are impelled to structurally and systemically adopt such arguments, like those contained in formal hierarchical structures, such as environmental audit or formal position, of a sustainability officer, not just as a way to solve their problems but to conform to institutional myths and societal expectations. In those symbolically and materially empowered actions, what Banks gets in return is legitimacy, money, and public esteem the ingredients that are necessary for the continued fighting fit. The results provide empirical evidence to suggest that the presence of environmental justice institutions and regulatory pressure might increase (or decrease) the motivation of firms, particularly among firms with high exposure to pollution, in adopting green practices and technologies. It underscores the dynamic nature of Leg, and the pressing need for banks to adapt the risk management practices GB practice, GBI and GBP linked to reflect shifting societal norms, or environmental standards. The current research adds to the Legitimacy Theory through demonstrating that EM Banking practice has antecedents in the presumed social accuracy motivation, regulatory legitimacy and reputational legitimacy, driving attempts to seek the realization of BSP.

Practical ImplicationsThe findings of this study have several practical implications for banks, policy-makers and sustainable groups. The result confirms that GB, GBI and GBP have a significant influence on BSP. Most importantly, GCSR moderates these relationships, emphasizing its critical role as a moderator.

Social performance in banking Positive SP/Environmentally-friendly corporate practices: Banks can reduce the negative social costs associated with doing business through various GB practices such as encouraging paperless transactions, funding environmentally-friendly projects and adopting energy-saving methods. These practices are good for the environment and at the same time increase operational efficiency and long-term financial performance. By taking an active role in green activities, banks can position themselves as environmentally responsible organizations, satisfying the needs of consumers and investors who are looking for pro-environment attitudes. The GBI plays a positive role in PME. Lack of confidence. Financial institutions need to prioritize full disclosure through various marketing, public relation and stakeholder engagement activities. Green images that will “impose” more confidence to its customers, that the green image will ideally enforce customer loyalty provide a competitive weapon in a long-term, green-driven market.

The role of GBP highlights the importance of policy-based programs such as the requirement of regulation, to support best practices. Banks should embed environmental factors into lending and investment practices provide staff with training on environmental risk and align policies with both national and international sustainability commitments. GCSR is a moderator that magnifies the effect of green action. When banks are themselves involved in CSR activities such as environmental sensitization projects, community greening and transparent environmental reporting, the positive effects of eco-friendly practices and policies become more significant. The discovery reflects that GCSR is not only a side function, and institutionalization of GCSR as a mechanism will increase the association between sustainability and performance.

This finding informs policy and regulation by indicating the need to create favorable incentives, standards and reporting requirements to encourage green activities. The regulatory system we create can protect banks and create conditions for sustainability and industry-wide environmental responsibility.

Limitations and Future ResearchThis study suffered from many of the limitations. The 420 participants may not be the face of banking. As the study was conducted by ICB and SOCB staff, the results are not necessarily universally valid. The current study can be extended by adding more participants, including clients and owners from different Bangladeshi banking organizations, especially FCBs (foreign-owned commercial banks) and non-bank financial institutions.

This study could be extended by investigating the mediating function of GBI on GB practices and bank sustainable development, profitability, and employees’ green behavior. If GBI is regarded as an in-between construct, we are able to better understand the extent to which the bank’s environmental imagery influences the financial and operational outcomes of green practices. In the future, it might be interesting to explore the way GBI influence employee motivation, commitment and environmental behavior in organizations. GB knowledge among the FCBs and the NBFIs employees differ greatly as a result of institutional regulations, training and strategic interests. Accordingly, further research may investigate additional institutions in different banking sectors and companies. Greater variation in bank types within the sample would shed more light on the impact of the institutional context on GBP knowledge, adoption, and efficacy. Future research might test the suggested model in other emerging economies to improve generalizability, as the analysis is restricted to Bangladesh.

This study approval constituted ethical clearance by the Faculty of Business Studies, Barishal University, Bangladesh on dated 10/04/2025 under the memo no. IQAC/TEM/EP-00194/10-04-2025. Written informed consent was obtained from all individual participants to the collection, storage, and use of their given information for research purposes.

Declaration of Helsinki STROBE Reporting GuidelineThis study adhered to the Helsinki Declaration. The Strengthening the Reporting of Observational studies in Epidemiology (STROBE) reporting guideline was followed.

Data will be provided by Corresponding Author [Md. Abu Issa Gazi; E-mail: maigazi@yahoo.com] upon reasonable request.

Conceptualization, AAM and MSH; methodology, AAM; software, MSH; validation, MAIG, LBH, ARBSS, AA and SHA; formal analysis, AAM and MSH; investigation, MBA, MAIG, LBH, ARBSS, AA and SHA; resources, MBA, MAIG, LBH, ARBSS, AA and VF; data curation, LBH, AAM and MSH; writing—original draft preparation, MAIG, AAM and MSH; writing—review and editing, XX; visualization, MBA, MAIG, LBH, ARBSS, AA and VF; supervision, AAM; project administration, MAIG; funding acquisition, AA, SHA, ARBSS, and VF. All authors have read and agreed to the published version of the manuscript.

Authors declare no conflicts of interest.

The authors extend their appreciation to the Deanship of Research and Graduate Studies at King Khalid University for funding this work through a small-group Research Project under grant number (RGP.1/27/46). And, this study is supported via funding from Prince Sattam bin Abdulaziz University project number (PSAU/2025/R/1446).

This research was supported by the University of Debrecen Program for Scientific Publication and was supported by the INTI International University, Malaysia.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

32.

33.

34.

35.

36.

37.

38.

39.

40.

41.

42.

43.

44.

45.

46.

47.

48.

49.

50.

51.

52.

53.

54.

55.

56.

57.

58.

59.

60.

61.

62.

63.

64.

65.

66.

67.

68.

69.

70.

71.

Gazi MAI, Masud AA, Howlader LB, Senathirajah ARBS, Howlader MS, Amin MB, et al. Green banking and sustainable performance in developing economy: Exploring the mediating role of green brand image and green banking policy with the moderating effect of green CSR. J Sustain Res. 2025;7(4):e250077. https://doi.org/10.20900/jsr20250077.

Copyright © Hapres Co., Ltd. Privacy Policy | Terms and Conditions